Professional help with your biggest purchase.

Nobody wants to operate on themselves and few would conduct their own divorce and yet almost everyone thinks that when it comes to finding a new home they are the best people to search for one, fall in love with it, evaluate it and then negotiate the best deal. TheContinue Reading

Another Stamp Duty tweak?

Dredging around for an election lifebelt Chancellor Jeremy Hunt is running another pre-Autumn Statement flag up the flagpole to see how it flys. The scoop in The Times this morning floats the idea of starting Stamp Duty at £300k rather than at £250k as at present? My thoughts? I hadContinue Reading

Spring Budget 2024

Today’s Budget held precious little for the housing sector with only a few modest changes announced and little else buried in the Office for Budget Responsibilities report. Capital Gains Tax for higher rate tax payers will be reduced from 28% to 24% for second home sellers. However, Landlord groups workingContinue Reading

“Is Henry Pryor a good buying agent?” 🤖

AI is going to change the world, we are told and like other professions estate agents are desperately running around trying to work out the impact on the buying and selling business. Is AI just going to write their sales particulars or might they themselves be obsolete in five yearsContinue Reading

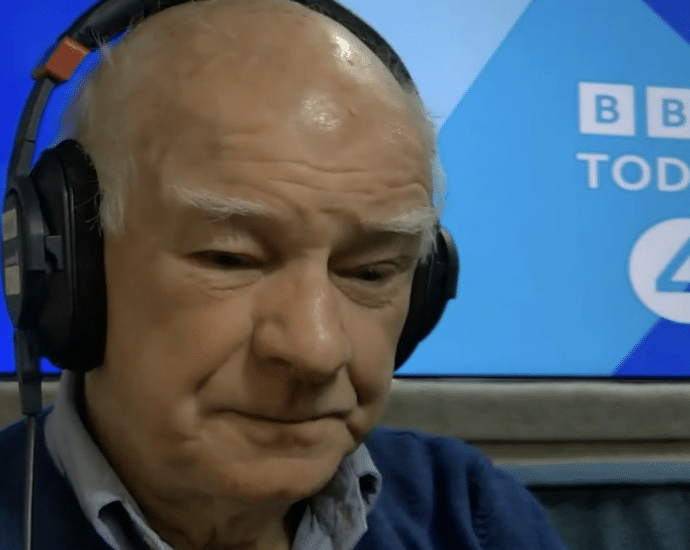

Not that difficult to buy a home, says NatWest chair!

NatWest’s chairman has said he believes it is not currently “that difficult” for people to get on the housing ladder. Sir Howard Davies said people have always had to save for a deposit but admitted you had to save more today. He told the Today program that he recognised peopleContinue Reading

Autumn statement

In summary, there wasn’t much for housing – to make it easier to move or encourage more people to move. To make homes greener or to build more social housing. Little to help tenants or to encourage landlords & nothing new for those facing steep rises in mortgage costs. ThereContinue Reading

Forecast for 2024?

The first house price forecasts for 2024 are appearing despite the threat of recession, inflation (CPIH) still over 6% and interest rates held by Bank of England at 5.25%. 5 Year fixed-rate mortgage are available at 4.8% but many are higher. First out of the trap are my old friendsContinue Reading