Today’s Budget held precious little for the housing sector with only a few modest changes announced and little else buried in the Office for Budget Responsibilities report.

Capital Gains Tax for higher rate tax payers will be reduced from 28% to 24% for second home sellers. However, Landlord groups working on the back of what will now be a much more expensive fag packet only property gains of more than £67,000 will attract less CGT after April 2024 than they would have two years ago. Even then, they estimate, the benefit is marginal at best.

Furnished Holiday Lettings tax regime “is creating a distortion meaning that there are not enough properties available for long term rental by local people” he said in the budget” according to Jeremy Hunt. These laws allowed landlords to deduct the full cost of mortgage interest payments from their rental income and pay lower capital gains tax if they sold up.

Multiple Dwelling Relief which was introduced to those buying more than one house in a single transaction, will be taken away from June.

Loosley connected is the Chancellors promise to replace the current tax regime for non-domiciled people who live in the UK and pay tax on UK earnings, while maintaining a main home overseas. As of April 2025, new arrivals won’t be asked to pay tax on foreign income for four years. If they continue to reside here, they will “pay the same tax as other UK residents.

There had been hopes from the likes of Martin Lewis that the Lifetime ISA (LISA) cap for first-time buyers would be lifted. It wasn’t.

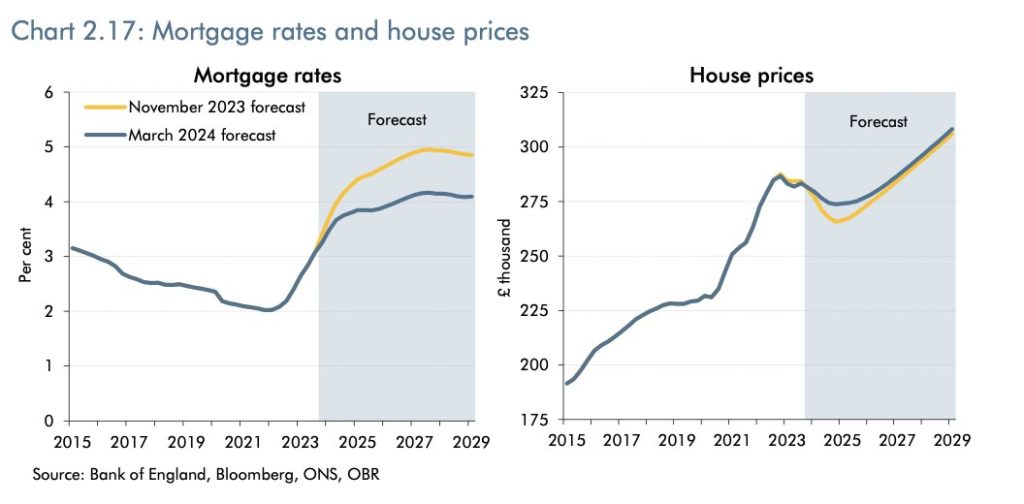

The OBR suggests that there will be little change to mortgage interest rates, sale volumes or to prices in the short term. They expect mortgage rates to be 0.8pp below previous [Autumn 2023] forecast to peak at 4.2%, with transactions flat in 2024 [down 7%] and prices down 2% [down 5%]