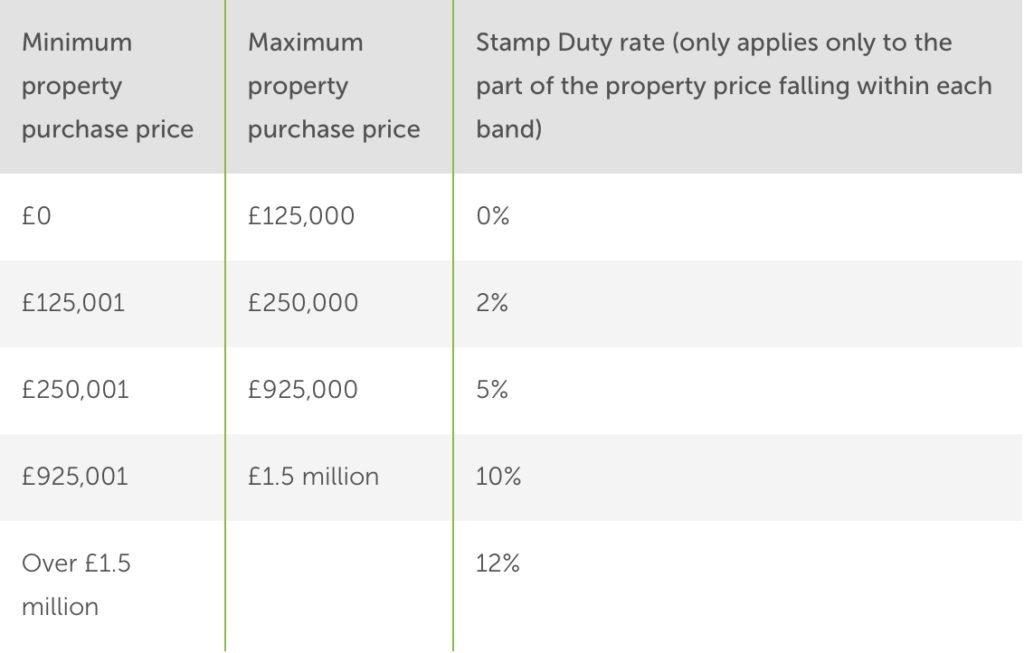

When you buy a property you will have to pay Stamp Duty Land Tax, a ‘purchase tax’ now payable within 14 days of completing on the purchase. It varies depending on the price you pay and whether you are a first time buyer, an overseas resident, a company, if you are buying a second home and what kind of property you are buying. Different formula apply to single dwellings or ‘multiple dwellings’ like houses with a flat or granny annex.

The tax is self-assessed i.e. it is declared by the taxpayer and open to challenge by the Revenue. It is a minefield and it is easy to both over-pay and to pay less than you ought to.

There are lots of shiny firms who claim to be able to help you to reduce your Stamp Duty exposure. Some are legit, some are less so and it’s unlikely that it will be them that the Revenue will chase if they think you have made a mistake. HMRC are keen to remind people “We would warn those buying a property that if someone approaches you saying they can reduce your stamp duty bill, you should be very careful – you may have to repay all the tax you reclaim and a penalty as well. If something seems too good to be true then it almost certainly is.”

If you’d like some independent advice please contact;