The monthly house price updates have landed provoking some discussion & some alarming headlines.

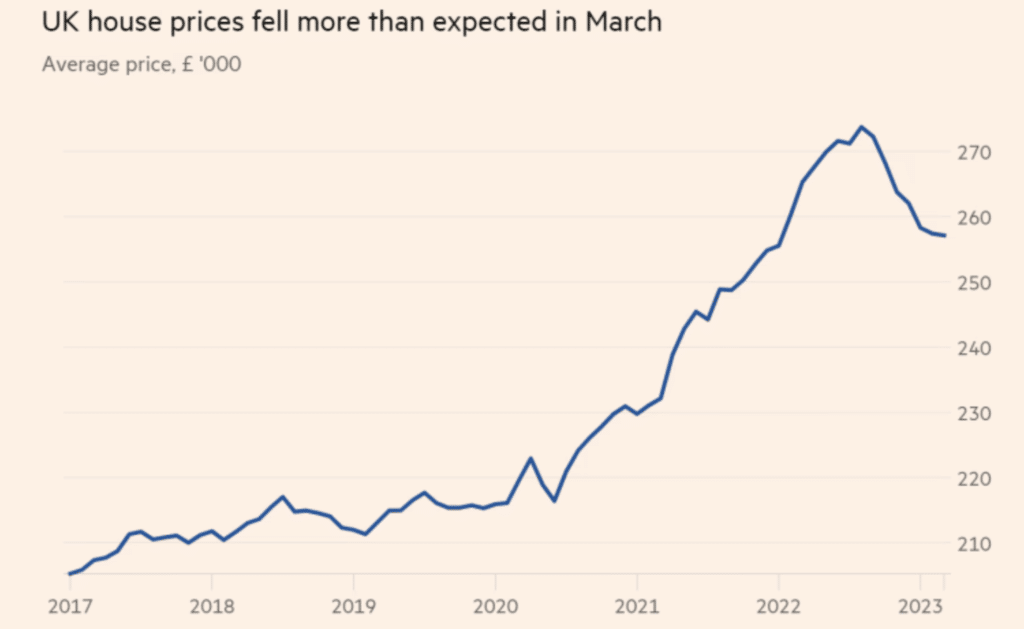

UK house prices fell more than expected and by the most since 2009 in March, according to data from mortgage provider Nationwide reports the Financial Times.

House prices fell by an annual rate of 3.1 per cent in March, following a 1.1 per cent decline in the previous month and marking the largest drop since July 2009, data showed on Friday. That was a larger fall than the 2.2 per cent forecast by economists polled by Reuters.

Property prices fell 0.8 per cent between February and March, also a larger drop than expected. The average house price has now fallen to £257,000, down from a peak of about £274,000 in August.

Updates from the ONS/Land Registry paint a confusing picture with Average UK house prices at £290,000 in January 2023 – a figure that’s £17,000 higher compared to January last year. However, it puts the annual rate of inflation at 6.3%, which is notably lower than the 9.3% posted by the ONS in December, and the 10.2% it posted in November. On a monthly basis (seasonally adjusted), average UK house prices fell by 0.6% in January, following a decrease of 0.4% in December 2022.

Rightmove – which reports property asking prices on its portal – puts annual house price growth at 0.8% in March. According to Rightmove, annual house price growth stands at 3%, with asking prices now £5,800 below the peak reached in October 2022.

One final bit of data is perhaps the most illuminating – the number of mortgages approved for house purchase remained weak at 43,500 cases in February 2023, almost 40% below the prevailing level a year ago.