The official UK House Price Index told of near-16% growth in the 12 months to July 2022, with the latest reading still tickling double figures but prices have now stalled. There have been 14 consecutive questers of positive house price growth. A correction is necessary and inevitable but what a difference a mini-Budget makes. In early September Hamptons were expecting prices to flatline through 2023. Today they’re not so sure.

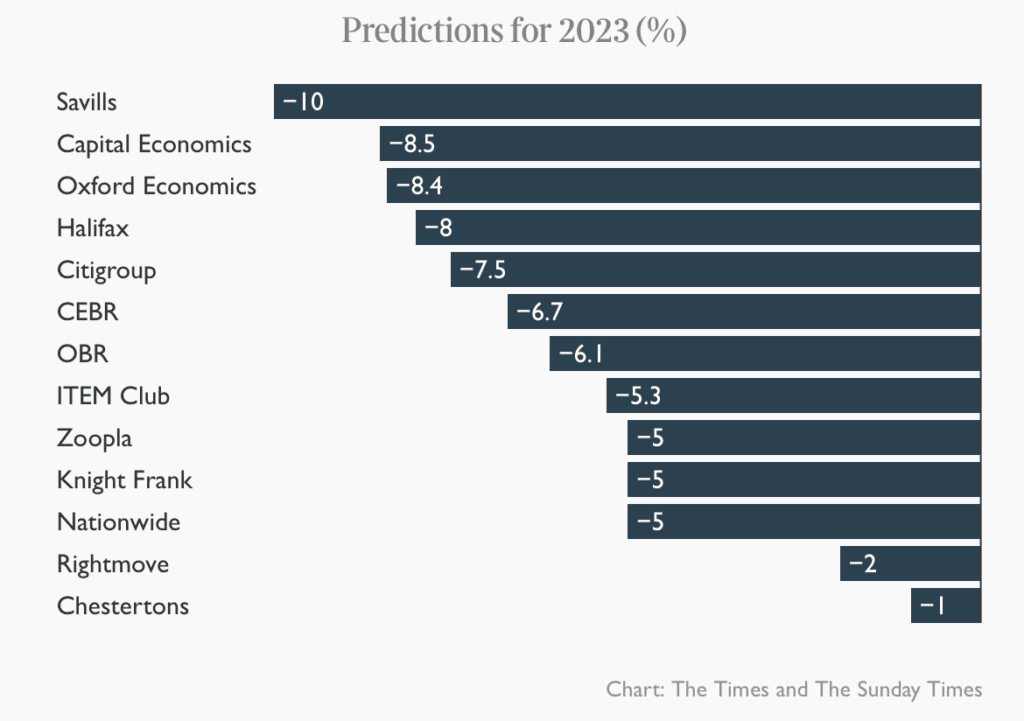

- Estate agency Knight Frank forecasts prices will drop by 5% in 2023, and a further 5% in 2024

- Analysts Capital Economics predict house prices will fall by a total of 12% by mid-2024

- Natwest estimates that house prices will go down by 7% next year

Britain’s biggest mortgage lender, Lloyds Bank Plc, revealed that it expects average house prices to fall by around 8% in 2023 – with a worst-case scenario involving a 17.9% crash (the best case is a 2.7% dip) but Nationwide warn that (worst case) they could fall by 30%! (subsequently updated to a more modest fall of 5% at Christmas). The banking giant’s base case assumption is currently that house prices will end the current five-year period (to 2026) roughly where they are now.

Investment bank Credit Suisse and forecasting house Capital Economics both suggested house prices could tank by up to 15% if interest rates climb above 6%. Capital Economics boss Roger Bootle argued that “UK house prices are “overvalued by a third and likely to fall”. Capital Economics have revised their expectations for 2023 about once a week, it feels.

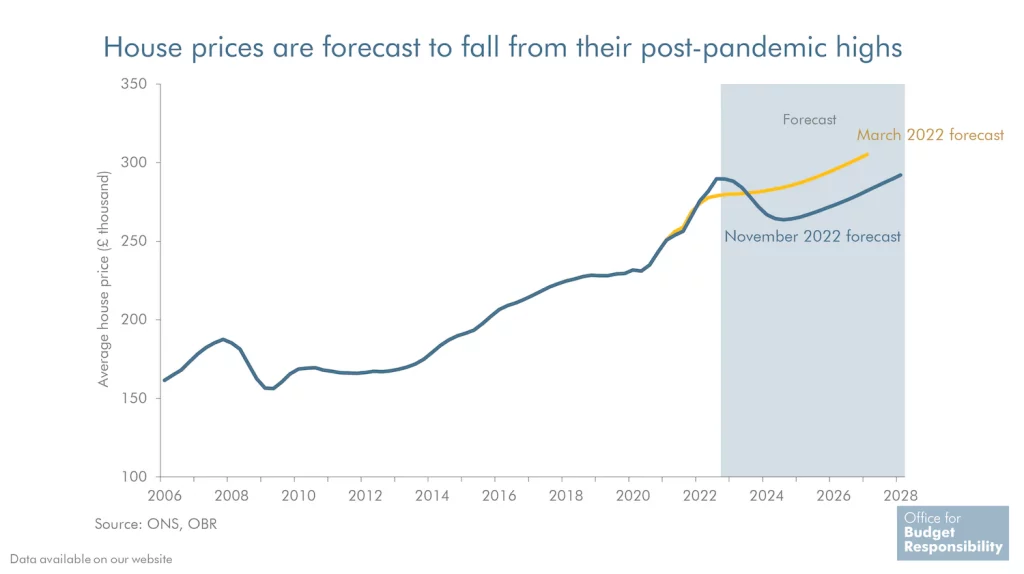

Last week, the Office for Budget Responsibility slashed its UK house price forecasts, from the +15.8% growth over five-years envisaged in March this year, to a drop of around 1% to the end of the same period. The OBR’s latest revision (forecasts have been bouncing up and down every six months for a couple of years) anticipate a sharp 9% correction for average house prices over the next two years, before the property market returns to a more even keel with prices rising by c.2.6% a year from 2025.

There are a few reasons to worry about next year but my guess is that in five years time prices will be back where they are now. I could bang on for hours about why but it’s just a view and worth not more or less than anyone else’s. So, here’s what some experts think;

UK house price growth forecasts

- Chestertons -1% (2023)

- OBR: -1.2% (2022-2026)

- Lloyds Bank: +0.2% (2022-2026)

- Knight Frank: -5% in 2023 (+1.5% 2022-2026)

- Nationwide -5% in 2023

- Savills: -10% in 2023 (+6% 2022-2026)

- Halifax -8% in 2023

- JLL: -6% in 2023 (+8.9% 2022-2026)

- Strutt & Parker: +10 – 15% (2022-2026)

- Harry Hill, Cº-20% (founder of Rightmove and industry legend!)

My own view for next year? As I told the Moneyweek Wealth Summit last Friday my expectation is that prices will end 2023 down by around 10%.

I think it was Ian Cowie who reminded us that “There are only two types of ‘expert’ when it comes to predicting house prices – those who don’t know & those who don’t know they don’t know.”. Over the Christmas holidays there will be many who will queue up to have a go at predicting what will happen but most will be instantly forgotten.