The amount of stamp duty you pay depends on the cost of the property.

These are:

- £0 – £250,000 (£425,000 for first time buyers) = 0%

- £250,000 – £925,000 = 5%

- £925,000 – £1,500,000 = 10%

- £1,500,000+ = 12%

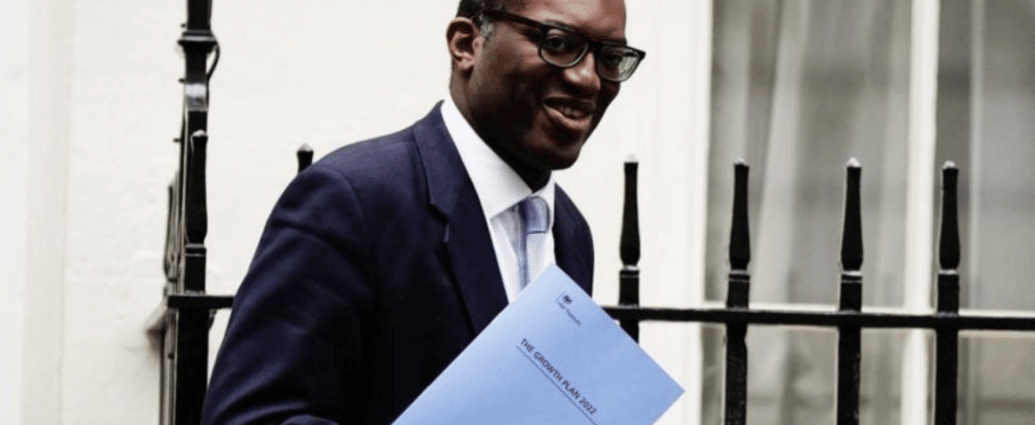

The chancellor added: “We’re going to increase the value of the property on which first-time buyers can claim relief, from £500,000 to £625,000.”

He said the steps would take 200,000 more people out of paying stamp duty altogether, adding “this is a permanent cut to stamp duty, effective from today.”

You can also use the government’s Stamp Duty Land Tax (SDLT) calculator to find out how much you have to pay.

What are rates in Scotland and Wales?

In Scotland, the current rates for the Land and Buildings Transaction Tax are:

- £0-£145,000 (£175,000 for first-time buyers) = 0%

- £145,001-£250,000 = 2%

- £250,001-£325,000 = 5%

- £325,001-£750,000 = 10%

- £750,001+ = 12%

Scottish landlords pay an extra 4% Land and Buildings Transaction Tax on top of standard rates.

For example, a second-time buyer purchasing a home worth £425,000 in Scotland would pay £15,850.

The current rates for Wales‘ Land Transaction Tax are:

- £0-£180,000 = 0%

- £180,001-£250,000 = 3.5%

- £250,001-£400,000 = 5%

- £400,001-£750,000 = 7.5%

- £750,001-£1.5m = 10%

- £1.5m + = 12%

Welsh landlords pay an extra 4% Land Transaction Tax on top of standard rates.