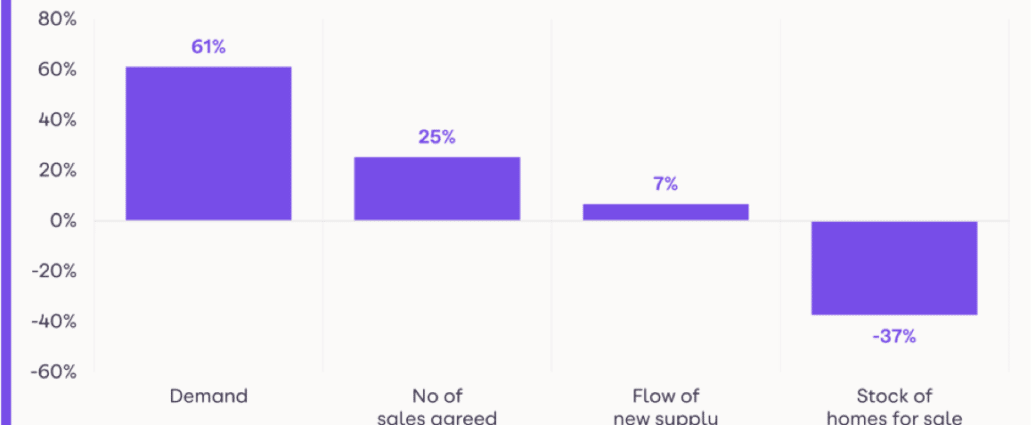

The latest Hometrack market report suggests that whilst new supply coming to market is starting to pick up overall stock levels are still low. There are 7% more properties coming onto the market compared to the five-year average. However, stock of available homes is still 37% below average.

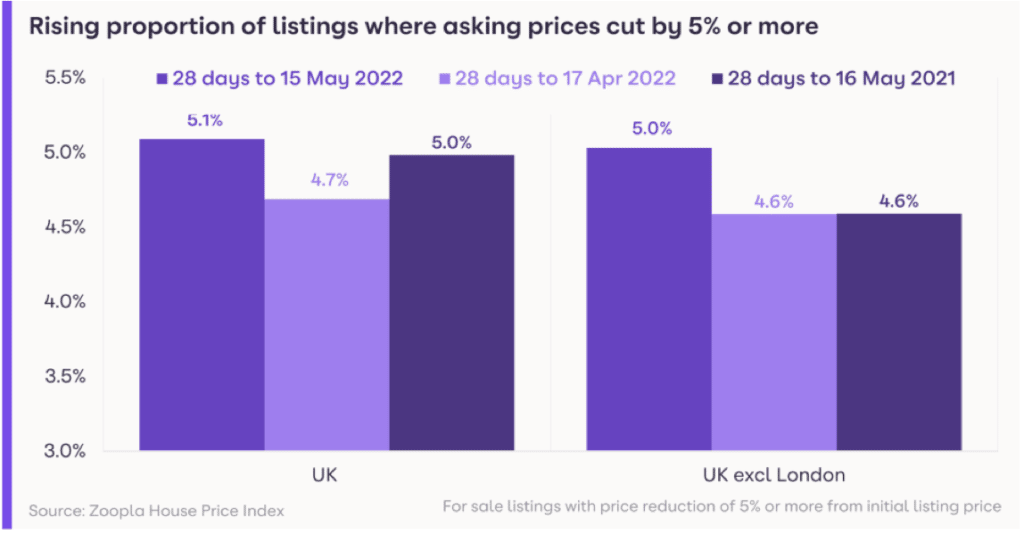

The proportion of listings where asking prices have been reduced is also rising. 1 in 20 listings (5.1%) have been re-priced in the last month & the reduction is 9%.

The price of an average UK home rose by £456 in April, taking the average value to £250,200 – another record high. The annual rate of growth in house prices is now at 8.4%, although this is down from 9% in March and April.

Given the increase in house prices and mortgage rates, affordability considerations for buyers will be front of mind. The average mortgage payment for an average-priced property has risen by £71 a month or £852 a year since the start of the pandemic. The average income needed to secure a mortgage on an £250,000 property, based on 4.5 x income has also risen by £4,500 over the same period.

My old firm Savills have revised their five year expectations this week but Hometrack expect the rate of price growth to ease – on a monthly basis price growth has already moderated. A continuation of this trend, with some monthly declines, will mean annual price growth, they think, will reach +3% by year end.