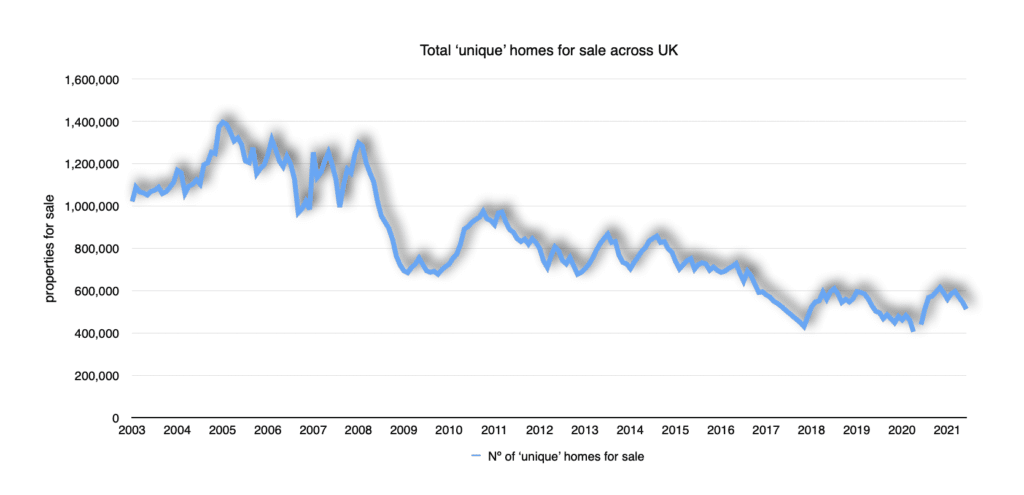

The latest monthly RICS survey of their members who sell homes says that price rises are slowing but that a shortage of homes for sale is a large part of what is keeping prices boiling. There is no expectation that prices will fall, just that the pace at which they have been rising is expected to slow.

Like many I had expect more stock to become available once people had had their two jabs and were more comfortable having strangers in their homes. With the majority of adults now double-jabbed and most having had the suggested two week period following their second there is still no sign of a significant additional numbers of sellers. Reasons for this vary – some may be holding back because they can’t find anywhere to move to, some because they have more pressing issues. What’s clear is that the stock that is left is a mixture of good property and a lot of dross. Like the last Turkey in the shop, there are a surprising number that have been well thumbed and that are clearly not what buyers are looking for.

It’s also worth mentioning that whilst prices are up more than 10% in many places it is still possible to ask too much and there are growing signs that some buyers are simply not prepared to pay whatever it takes to buy a new home.

Shortage of stock may be one reason why prices are rising but the biggest reason is how cheap mortgage finance is and how available it is for many. Deals at sub 1% are not uncommon which together with longer loan terms is making bigger loans more affordable for many. One of my main worries is how many of my kids generation now view the cost of a home not as a total sum but as they would a new car, the size of the monthly payments. Many reference the equiverlant rent.

The next watershed should be September if when the schools go back. Traditionally people will then put their homes up for sale with the hope of moving before Christmas. Agents tell me that they are doing ‘market appraisals’ and these would usually lead to homes being marketed. Will they come in the Autumn or are we just seeing lots of people checking to see how much their house has gone up during the pandemic?

I keep an eye on the sales inventory on websites like Rightmove. Unique listings (the number of individual homes) for sale is about 20% below average it seems.

Sales volumes are up. When we get to see the number for June it may be close to 100% more than usual as people rushed to try and beat the changes to the Stamp Duty holiday. Despite the Pandemic I expect around 1.3m homes to sell this year which is about average over the past decade.