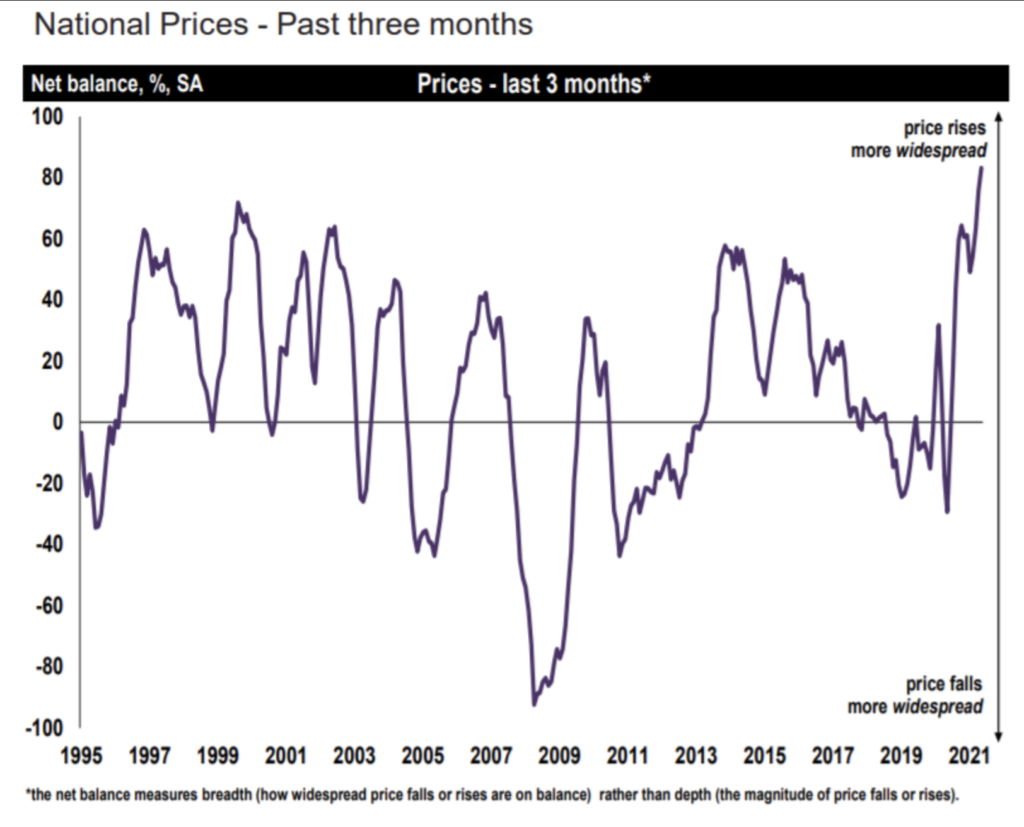

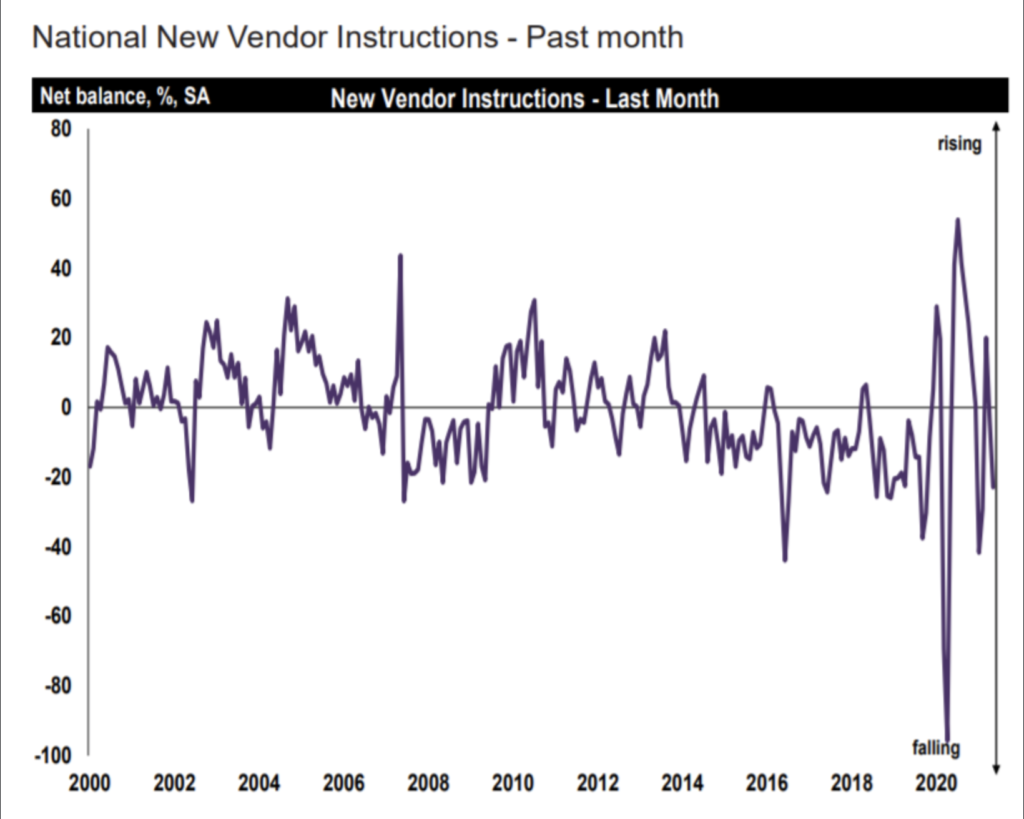

The monthly RICS housing sentiment survey is widely reported this morning highlighting two things – that prices are up and that the supply of homes for sale is down.

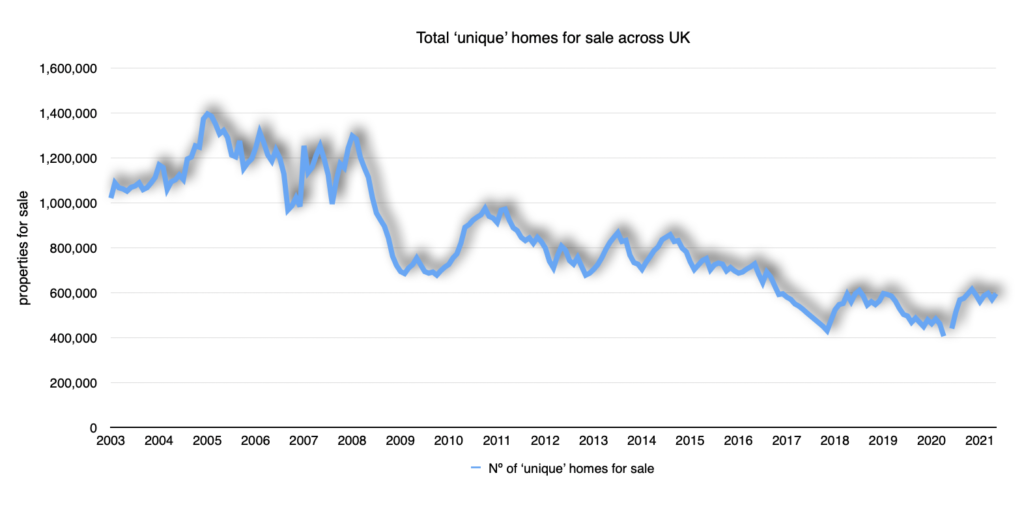

I keep my own tally of unique listings drawn from Rightmove and Zoopla. It’s not an exact science but having stripped away the duplicates, the same property listed with more than one agent and tried to allow for the same property being advertised twice by the same agent (which happens more than you might think) then on average there would be over 800,000 homes for sale. I think that today there are just 500,000.

Rightmove says today that there is a pipeline of about 705,000 properties that are under offer, sold but not yet exchanged many of which will be trying to beat the end of the Stamp Duty holiday at the end of the month. Lots will fail to exchange let alone complete but it seems like June is going to see a spike in sales regardless just as we have previously when there are changes to Stamp Duty or other taxes.

As many buyers know, waiting for a suitable property is really painful at the moment and when anything half decent does come up it is chased by 10-20 others. Being nimble and able to move quickly is essential so that you can lock down a deal as quickly as possible when the right thing does present itself.

I still expect more stock to come onto the market as sellers get vaccinated and feel more confident having strangers around their home. Agents competing for this new stock will be optimistic when setting asking prices although most will sell for less. About 30% of properties are reported to be selling in excess of the guide.

Savills, my old firm, have some incite from their hugely impressive research department.

- Data from TwentyCi shows that sales agreed in May were 6% lower in April across the market as a whole and 10% lower in the market between £500,000 and £1mil (where stamp duty savings have had the biggest impact).

- Yet, overall they remain 42% above market conditions and 87% above 2017-2019 levels in the market above £1mil.

- This combined with much lower relative levels of stock coming to the market suggests further short term upward pressure on prices. However we expect this to be at reduced rates as some of the current market intensity starts to ease.

- With that in mind, sellers shouldn’t let their price expectations run away with them if they are to take advantage of current market conditions.

It’s still too early to be certain but it does look like this is ‘the new normal’ we have talked about over the last year and when it comes to prices, crazy though it may be I think we need to expect them through the remainder of 2021 to hold rather than to fall back. I still think that we will be able to be more confident come September but I don’t think homes are going to be any cheaper this year and in some places they are going to be (even) more expensive!