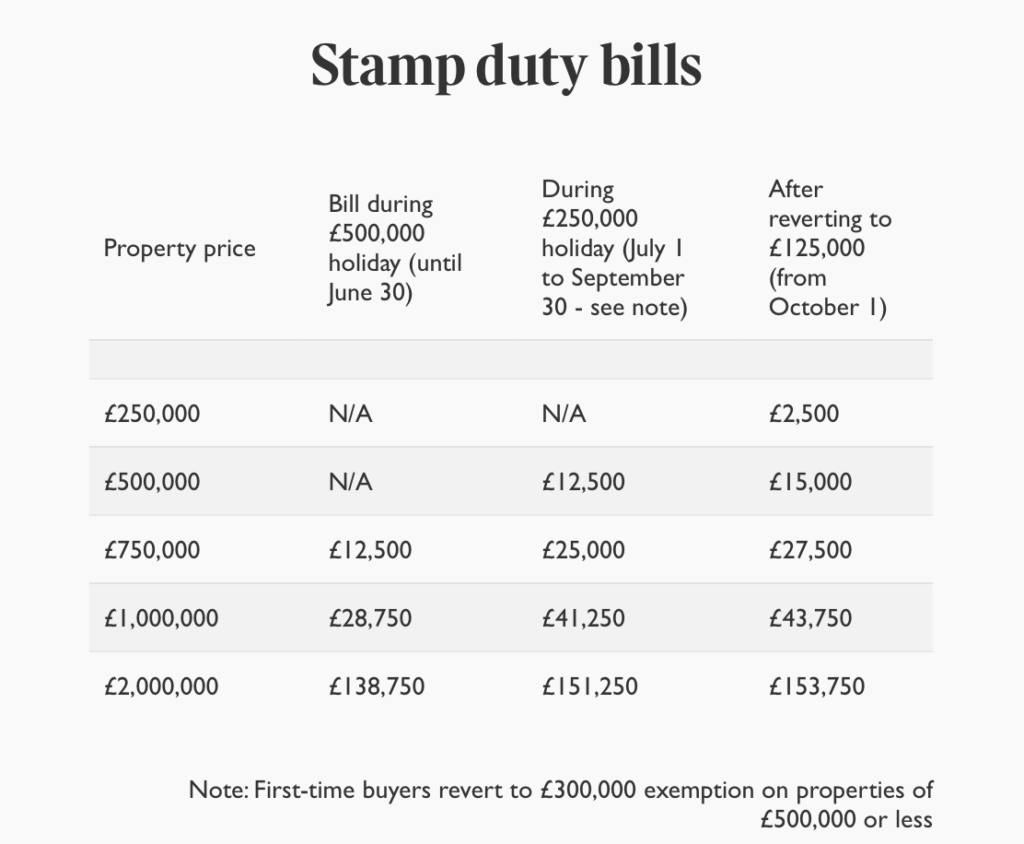

The stamp duty holiday on house purchases has been extended for a further three months, Chancellor Rishi Sunak announced in his Budget.

The property purchase tax has been suspended on the first £500,000 of all sales in England and Northern Ireland since 8th July last year.

The tax break for will now continue until the end of June.

After that the nil rate band will be set at £250,000 – double its standard level – until the end of September.

Rishi Sunak told MPs the extra move was “to smooth the transition back to normal – and we will only return to the usual level of £125,000 from October 1”.

The stamp duty holiday was introduced to help buyers who might have taken a financial hit because of Covid. It was also intended to boost a property market hit by lockdown.

During the stamp duty holiday there has also been some relief from the equivalent taxes for property buyers in Scotland and Wales – which is set to end on 31 March. Those who follow me on social media will be aware that I’m not convinced that this is a good idea although it seems to be great for business!

This is the Government summary to help you work out what this means if you are buying a residential property;

“The temporary increase to the nil rate band for Stamp Duty Land Tax, which is the rate before you start paying SDLT on residential property has been extended.

“Rather than ending on 31 March 2021, the temporary nil rate band of £500,000 will be in place until 30 June 2021. Then from 1 July 2021 to 30 September 2021 the nil rate band will be £250,000. The nil rate band will return to the standard amount of £125,000 on 1 October 2021.

“If you purchase a residential property between 8 July 2020 to 30 June 2021, you only start to pay SDLT on the amount that you pay for the property above £500,000. These rates apply whether you are buying your first home or have owned property before.

“From 8 July 2020 to 30 June 2021 the special rules for first time buyers are replaced by the reduced rates set out above.

“If you purchase a residential property between 1 July 2021 to 30 September 2021, you only start to pay SDLT on the amount that you pay for the property above £250,000.

“From 1 July 2021 the special rules and rates for first time buyers apply, including first time buyers purchasing property through a shared ownership scheme.

“The three per cent higher rate for purchases of additional dwellings applies on top of temporary reduced rates above for the period 8 July 2020 to 30 June 2021 and also for the period 1 July 2021 to 30 September.

“From 1 October 2021 the higher rates will then apply on top of the standard rates of SDLT.

“The nil rate band which applies to the ‘net present value’ of any rents payable for residential property is also increased to £500,000 from 8 July 2020 until 30 June 2021. From 1 July 2021 to 30 September 2021 the nil rate band will then be decreased to £250,000.

“Companies as well as individuals buying residential property below the nil rate band thresholds shown in the above tables will also benefit from these changes, as will companies that buy residential property of any value where they meet the relief conditions from the corporate 15 per cent SDLT charge.

“On the 1 October 2021 the temporary rates of SDLT will revert back to the standard rates that were in place prior to 8 July 2020.”