Last January the BBC repeated it’s annual round of house price predictions. This year they have sensibly decided not to repeat the exercise.

Turned out we were all unable to see what would happen to house prices despite a number of experts changing their predictions (in some cases several times) during the course of the year.

According to Nationwide, house prices rose 7.5% in the year to November.

I doubt that this will stop everyone from voicing an opinion but I think it’s pretty clear that nobody knows what might happen to prices or to the other elements that fascinate us – transaction volumes, rents, repossessions and regional variations. The UK housing market seems not to be influenced by Covid, not impacted by Brexit, not bothered by lock downs and indifferent to a new President of the Free World. What do I expect will happen in 2021? Prices may sag – by 5-10% I suspect but I doubt that they will crash.

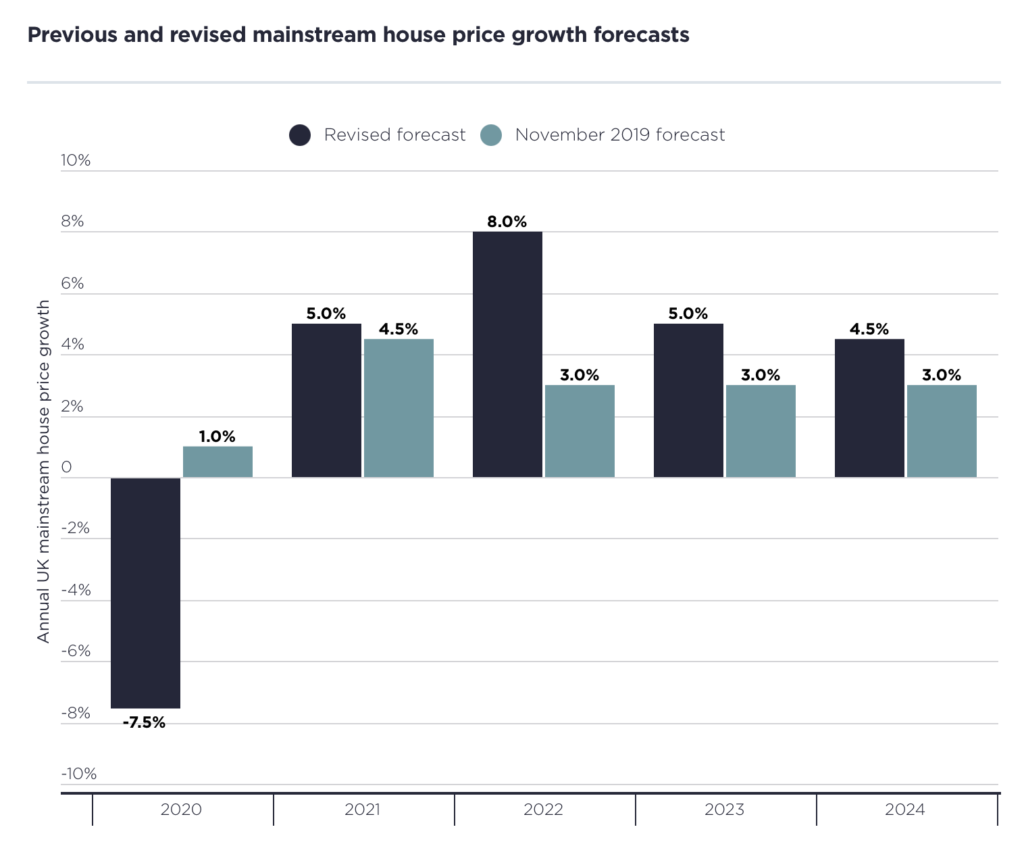

In November 2019, ahead of the General Election Boris Johnson would win Savills predicted a 1% rise in average house prices in 2020. In June 2020 my old firm said that they expected prices would fall 7.5%. Three months later in September they said that they then expected prices would rise by 4%.

Sale volumes will slip but supply should hold up as there is no cost to putting your property on the market. Agents will always take a punt just in case and whilst many buyers may struggle to justify ever higher prices but many won’t.

According to The Express “a house price drop is inevitable”.

Phil & Kirstie in The Mail suggest that this may be “the perfect storm”. Kirstie rightly reminds us that that “there is a greater division between the haves and the have-nots.”

Strutt & Parker expects prices to remain fairly secure and stable throughout 2021, it predicts that house prices are likely to rise by 15% to 25% between now and the end of 2024.

One of the few optimists, Jackson-Stops expect a 2% INcrease in 2021.

Rightmove “UK housing market ‘to grow four per cent'”.

The consensus, from Capital Economics, EY Item Club and the CEBR, is that property prices look set to fall by up to 5% next year. The Office for Budget Responsibility suggests a fall of 8.3% by the end of the year. It did not foresee house prices starting to recover until the end of 2022.

Personally, I’m advising my buying clients to be cautious in 2021 but not to be frightened about committing to a property that could be a home. The Stamp Duty holiday is a distraction but one that many will be distracted by. I’m suggesting clients build in a clause in contracts that reflects the notional saving and that the purchase price will fall by this amount for deals that complete in April.

So, as you can see, there are as many predictions as there are people you stop and ask. Nobody knows but few will admit that they don’t. If I did know then you wouldn’t be able to get hold of me on my yacht off the Amalfi coast! So plan sensibly, negotiate hard and above all make sure you get on and live your life to the full. If 2020 has taught as all one thing it’s just how mortal we all are and that there are some things more important than house prices!

Happy New Year.